XMPT

Simplify your exemption cert management

If you've struggled with manual, error-prone exemption certificate management across multiple buyer/seller relationships and channels, TAXDAI's XMPT eliminates the friction. Set up your profile, and our AI-driven automation for creating, storing, using and sharing delivers the right documentation at transaction speed.

What is TAXDAI's XMPT?

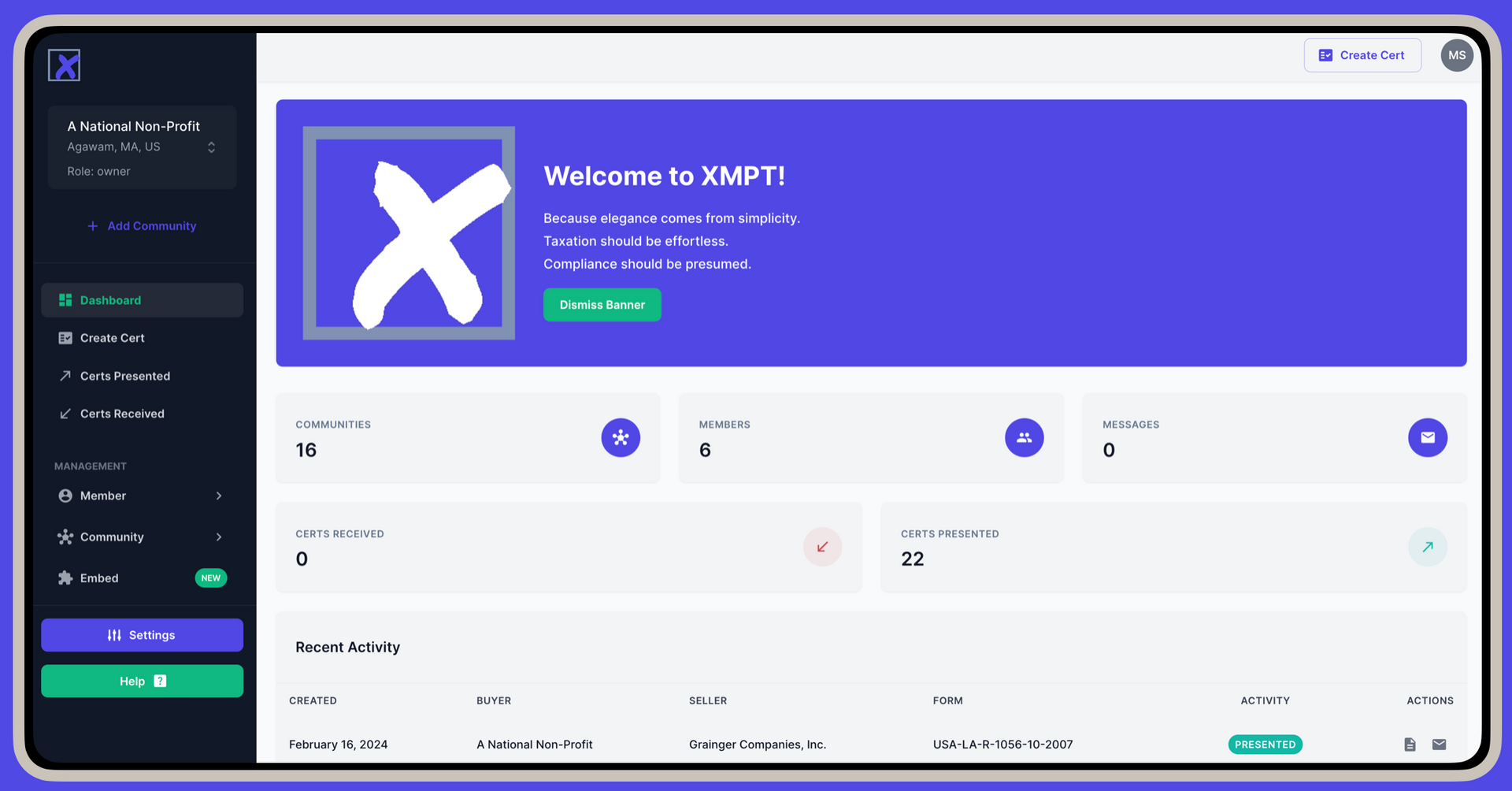

XMPT is a cloud-based platform for automating exemption certificate processes across your entire digital ecosystem. The platform provides user-friendly access to capabilities like:

- AI-guidance to pick the right certificate type and reason

- Auto-filled forms with your existing customer/supplier data info

- Bi-directional integration with any system (ERP, procurement, marketplace, tax)

- Real-time compliance checking for every transaction

- Full audit support for every certificate

Say goodbye to documentation headaches and hello to seamless, automated compliance.

The benefits are easy to see

The XMPT platform connects all parties involved in exemption certificate processes through a central integration layer. Buyers and sellers access a shared system for automated creation, storage, sharing and use of certificates.

For buyers, XMPT eliminates manual form selection and completion by guiding users through our AI-driven process. Relevant customer info auto-populates and XMPT pinpoints the right documentation and details based on business context.

For

sellers receiving certs, XMPT validates documentation status during the transaction. One-click sharing sends up-to-date certs to any party or system, and works with the tax calculation engine to accurately reflect reduced taxation.

Will XMPT work with our ERP, CRM, or tax calculation engine?

Absolutely. XMPT was built to integrate with any platform across your entire tech stack and supply chain network.

We have API connections for all the major ERP, CRM, procurement, marketplace and tax calculation platforms, including:

- SAP, Oracle, Microsoft Dynamics, NetSuite.

- Salesforce, Microsoft CRM, HubSpot.

- Ariba, Coupa, Jaggaer, Tradeshift.

- Amazon, Walmart, eBay, Shopify marketplaces.

- Avalara, Vertex, Sovos, CereTax, Thomson Reuters tax engines.

If you don't see your system listed, our Any-to-Any tax API architecture allows us to quickly build and map new integrations in just days, not months.

The best part? Smart exemption cert functionality gets embedded right into the systems and processes you already use daily. No more switching between separate apps - it works seamlessly in your existing flows.

But we already have CertCapture (or another ECM)

Yes, and CertCapture was a good first step, but it still relies heavily on tedious manual tasks that create friction and risk:

- Users have to manually select the correct certificate type and reason codes

- Data has to be re-entered into web forms instead of integrating with your systems

- There's no intelligent matching of certificates to specific transactions

- Certificate status isn't validated in real-time as orders are placed

- You have to log into a separate system instead of working within your flow

CertCapture was built for an earlier, pre-automation era. XMPT is the modern, intelligent solution that uses AI to truly automate across your entire ecosystem and eliminate those long-standing pain points.

Companies are making the switch from manual solutions like CertCapture to TAXDAI's unified, AI-powered approach. See for yourself what they're sayin'...

What does 'Any-to-Any' mean regarding tax compliance?

Traditionally, tax software vendors have provided point-to-point integrations between their solutions and a handful of other systems like ERPs or e-commerce platforms. This one-to-one connection model works okay if your operations are very simple and contained.

But in today's digital ecosystem world filled with multiple selling channels, ERPs, procurement systems, marketplaces, and tax engines, the old point-to-point method falls apart. You end up with a messy web of one-off integrations that don't talk to each other.

TAXDAI's Any-to-Any architecture serves as a unified integration layer connecting any system to any other system for seamless tax compliance automation.

With just one integration to our cloud platform, we sync data back-and-forth across all your tools - ERPs, procurement solutions, marketplaces, tax engines, billing systems, you name it. Our Any-to-Any approach delivers unlimited flexibility to streamline compliance across even the most complex environments. You'll never be boxed in by rigid integrations again.

How does TAXDAI compare to the competition?

TAXDAI stands out as the clear leader in modern, automated exemption certificate management compared to legacy solutions still stuck in the past.

Legacy Competitors

- Still rely on manual form selection and data entry.

- Only provide basic template management.

- Have limited ecosystem integration capabilities.

- Operate as separate silo'd applications.

- Use complicated pricing with surprise fees.

TAXDAI

- AI-driven automation for cert selection & creation

- Intelligent data mapping with connected systems

- Any-to-Any integration across entire tech stack

- Embedded functionality in existing workflows

- Simple, transparent

pay-as-you-go pricing

By delivering true intelligent automation through a unified platform, TAXDAI eliminates the age-old headaches of exemption certificate management that have persisted for decades.

Companies are ditching their archaic solutions and making the switch to TAXDAI to modernize and streamline this crucial compliance process. The benefits of our innovative approach are game-changing.

See for yourself, as we create and apply a 3-state SST cert in under a minute.

How does XMPT break the primacy of tax engines?

Exemption certificates are fundamentally about governing customer/vendor relationships and transaction legitimacy - not just tax calculations. Yet legacy solutions have remained overly dependent on tax engines for cert processes.

TAXDAI decouples certificates from tax determination, treating them as master data that spans your entire ecosystem of procurement, sales, finance and operations systems. We intelligently automate identity verification, document creation/collection, real-time sharing and auditing - all before ever involving the tax engine.

By breaking this dependency, TAXDAI can provide a centralized, universal cert management solution for any transaction model or business relationship across your supply chain. Certs become an embedded part of your core processes and compliance framework, not an afterthought. This holistic approach revolutionizes certificate governance.

Why don't you talk about risks & penalties like everyone else?

You're right, we don't spend much time fear-mongering about scary stories of audit penalties and risk like other vendors. That's because TAXDAI takes a more positive, empowering approach.

Rather than dwelling on fear, we prefer to highlight how TAXDAI gives businesses confidence through our automation capabilities. When you have an intelligent platform ensuring exemption certificates are created accurately and compliantly every time, there's simply no need to worry about audits.

So while the industry still uses scare tactics, we prefer to inspire confidence.

Wait, your system manages both buying and selling certs?

Legacy solutions have traditionally focused just on the accounts receivable (A/R) side - helping sellers collect certificates from buyers/customers. However, that's only half of the compliance picture. As a buyer, you also need to manage exemption certificates for accounts payable (A/P) transactions with suppliers.

TAXDAI is the only platform providing a complete, bidirectional approach for both A/R and A/P certificate processes. On the A/R side, we automate certificate creation, collection and storage for sales orders. But we also automate assigning and sharing the right documentation upstream to vendors based on purchase order details.

This unified system manages ALL certificate compliance responsibilities - whether you're the buyer or seller. No more juggling separate applications. TAXDAI ensures exemplary certificate coverage from both incoming and outgoing transaction perspectives for true exemption certificate governance.

Let's talk!

If you work in an industry with special compliance needs like those below, we really should discuss how TAXDAI can revolutionize your exemption certificate processes.

- Drop-shipping.

- Omnichannel retail.

- Wholesale.

- Manufacturing.

- Telecom.

- Multiple points of use.

- SaaS.

- Tier 1/Tier 2 supply chain.